Forex trading, or foreign exchange trading, is the process of buying and selling currencies on a global scale. As the world’s largest financial market, it opens up opportunities for individual and institutional traders looking to capitalize on currency fluctuations. For those new to this dynamic environment, understanding the fundamentals is crucial—a journey that can begin at what is forex trading https://acev.io/.

What is Forex Trading?

Forex trading involves the exchange of one currency for another in the hopes of making a profit. It is conducted on a decentralized market known as the forex market, where currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The aim is to predict whether a currency will rise or fall in value relative to another.

The Forex Market Explained

The forex market operates 24 hours a day, five days a week, making it one of the most accessible and liquid markets in the world. It comprises various participants, including banks, financial institutions, corporations, governments, and individual traders. Being decentralized means there is no central exchange or location; instead, trading is conducted over-the-counter (OTC) through electronic networks.

How Forex Trading Works

In forex trading, currencies are traded in pairs, with each pair consisting of a base currency and a quote currency. The base currency is the first one listed in the pair, and the quote currency indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, if the exchange rate is 1.20, it means that 1 Euro can be exchanged for 1.20 US Dollars.

Key Terms in Forex Trading

- Pips: The smallest price move that a given exchange rate can make based on market conventions.

- Leverage: A tool that allows traders to control larger positions with a smaller amount of capital, effectively borrowing funds from a broker.

- Spread: The difference between the buying and selling price of a currency pair.

- Lot: A standardized quantity of the asset being traded (e.g., 1 lot in forex often equals 100,000 units).

Benefits of Forex Trading

Forex trading offers several advantages, making it appealing to traders of all experience levels:

- High Liquidity: The forex market boasts unmatched liquidity, ensuring that trades can be executed quickly without significant price changes.

- Accessibility: With the advent of online trading platforms, individuals can participate with minimal investment and from anywhere in the world.

- Flexible Trading Hours: The decentralization of the forex market allows traders to engage at any time, providing flexibility that other markets may not offer.

- Potential for High Returns: Due to leverage, traders can amplify their potential profits (though this also increases risk).

Risks Associated with Forex Trading

Despite the numerous benefits, forex trading is not without its risks:

- High Volatility: Currency prices can fluctuate dramatically in short periods, leading to significant gains or losses.

- Leverage Risks: While leverage can enhance profits, it can also amplify losses, potentially leading to substantial financial harm.

- Market Manipulation: The decentralized nature of the market may expose traders to manipulative practices by larger participants.

Strategies for Successful Forex Trading

To navigate the complexities of the forex market successfully, traders often employ various strategies:

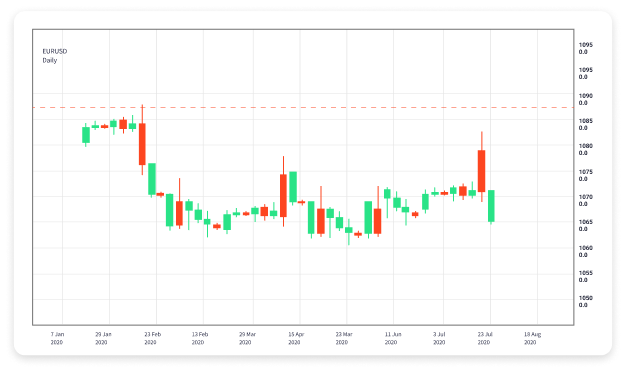

- Technical Analysis: Using charts and historical price data to forecast future movements, technical analysis involves indicators and patterns to make trading decisions.

- Fundamental Analysis: This strategy focuses on economic news, indicators, and geopolitical developments that can affect currency values.

- Day Trading: Traders buy and sell currency pairs within the same trading day, capitalizing on short-term price movements.

- Swing Trading: This strategy involves holding positions for several days or weeks to benefit from expected price moves.

Getting Started with Forex Trading

To embark on a forex trading journey, follow these steps:

- Educate Yourself: Understand the basics of forex trading, various strategies, and market factors.

- Choose a Reputable Broker: Research and select a broker that aligns with your trading style, offering a user-friendly platform and transparent fees.

- Practice with a Demo Account: Many brokers provide demo accounts that allow traders to practice without risking real money.

- Develop a Trading Plan: Create a comprehensive plan that outlines your strategies, risk management techniques, and trading goals.

- Start Trading with Caution: Begin with a small investment, gradually increasing your position as you gain more experience and confidence.

Conclusion

Forex trading is an exciting and potentially lucrative venture for those willing to dedicate time to understand its mechanisms and risks. By leveraging education, practice, and strategic planning, you can navigate this vast market successfully. As you embark on your forex journey, remember that continuous learning and adaptation are key to achieving long-term success.