Forex Trading for Dummies

Forex trading, short for foreign exchange trading, is the process of buying and selling currency pairs in the foreign exchange market. It can be a tantalizing world, especially for beginners. If you’re utterly new to Forex and looking for a straightforward introduction, this guide is designed for you. You’ll discover fundamental concepts and practical strategies that will help you start your Forex trading journey. Be sure to check out the forex trading for dummies Best Uzbek Brokers to have a reliable trading partner.

Understanding the Basics

Before diving headfirst into Forex trading, it’s essential to grasp the basic terminology used in the industry. Here are a few key terms:

- Currency Pair: Forex trading always involves two currencies, referred to as a currency pair. For example, EUR/USD represents the Euro and the US Dollar.

- Pips: This term indicates the price move in the forex market. Most currency pairs are quoted to four decimal places, meaning a value change of 0.0001 is one pip.

- Leverage: A tool that allows traders to control a more massive position size with a smaller amount of capital. However, leverage can also increase risks.

- Spread: The difference between the buying price (ask) and selling price (bid) of a currency pair.

The Forex Market

The Forex market operates 24 hours a day, five days a week, enabling traders from all around the globe to buy and sell currencies. The market is decentralized, meaning that there is no centralized exchange. Instead, the Forex market comprises a network of banks, financial institutions, and retail brokers that operate worldwide.

Main Trading Sessions

Forex trading is divided into three primary trading sessions: the Asian session, the European session, and the North American session. Each session has its own characteristics, such as volatility and trading volume. Here’s a breakdown:

- Asian Session: Usually considered less volatile, the Asian session opens with Tokyo and sees major currencies like the Japanese Yen and Australian Dollar traded.

- European Session: This session tends to have the highest volatility as it includes major financial centers like London, where most trading occurs.

- North American Session: This session overlaps with the European session, which can create high trading volume and increased market movements.

Getting Started with Forex Trading

To begin trading in the Forex market, you’ll need to follow a few steps:

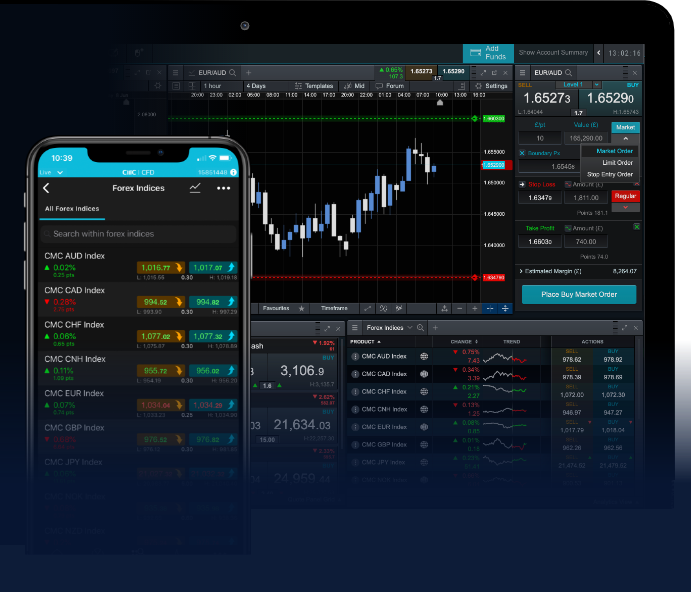

- Choose a Reliable Broker: Opt for a broker that meets your trading needs. Consider factors such as regulation, trading platforms, spreads, and support.

- Create a Trading Account: Once you choose a broker, open an account. There are typically different types of accounts, including demo accounts for practice and live accounts for actual trading.

- Practice with a Demo Account: Use the demo account to practice your trading strategies without risking real money. This helps build your confidence.

- Understand Trading Strategies: Familiarize yourself with various trading strategies, such as day trading, swing trading, and scalping. Each strategy has its pros and cons depending on your trading style.

- Start Trading Live: Once comfortable, you can begin trading with real money. Start with a small amount to minimize risk as you learn.

Forex Trading Strategies

There are numerous strategies that Forex traders use, but here are a few popular ones:

1. Trend Following

This strategy involves identifying and trading in the direction of the current market trend. Traders analyze charts and utilize technical indicators to spot established trends and execute trades accordingly.

2. Range Trading

Range trading is based on the idea that currency pairs will typically trade within a certain range over a period. Traders look to buy at the support level and sell at the resistance level.

3. News Trading

News traders take advantage of volatility that occurs during economic news releases. This strategy requires you to stay informed about economic events and understand how they can impact currency pairs.

Risk Management in Forex Trading

One of the most crucial aspects of trading is managing risk effectively. Here are some strategies to help you minimize risk while maximizing potential profits:

- Use Stop-Loss Orders: A stop-loss order helps limit potential losses by automatically closing a trade at a predetermined price level.

- Risk a Small Percentage per Trade: A common recommendation is to risk only 1-2% of your trading capital on any single trade. This helps protect your account from significant losses.

- Keep a Trading Journal: Maintain a log of your trades, strategies, and outcomes. This can help you identify patterns and improve your trading approach over time.

Conclusion

Forex trading doesn’t have to be intimidating, especially for beginners. By familiarizing yourself with the fundamentals, key terms, and effective strategies, you can gradually build your knowledge and confidence in the Forex market. Remember that practice is essential; start with a demo account and take your time to develop a solid understanding of how trading works before diving into live trading.

Embrace the journey of learning and refining your trading skillset, and you could become a successful Forex trader. Don’t forget to seek reliable resources and stay updated with market trends that can affect your trading decisions. Happy trading!