Mastering Mobile Forex Trading: Your Comprehensive Guide

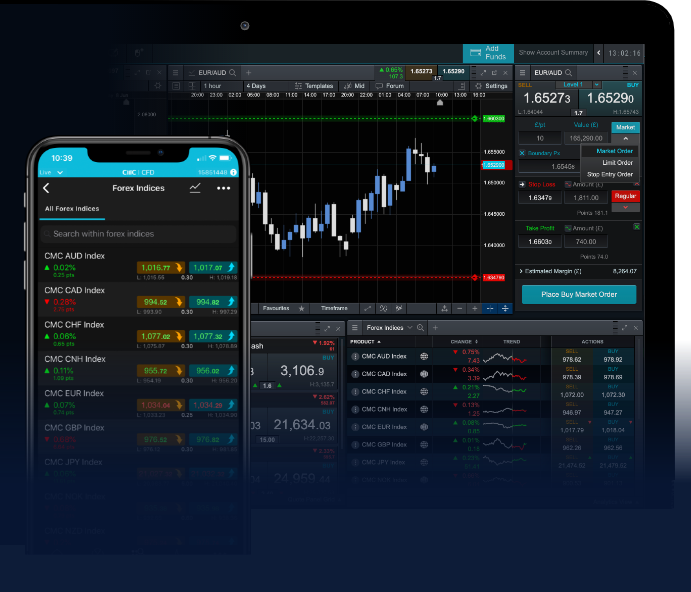

The financial landscape has undergone a remarkable transformation in the past decade, with mobile technology revolutionizing how traders engage with the foreign exchange (forex) markets. Today, mobile forex trading trading-uganda.com offers insights that highlight the vast potential of mobile forex trading platforms. In this guide, we will delve deep into the world of mobile forex trading, discussing its advantages, processes, and best practices to help both novice and seasoned traders thrive.

The Rise of Mobile Forex Trading

Mobile forex trading has surged in popularity due to the increased accessibility of the financial markets. Traditional trading methods often required traders to be tethered to their desks, relying on desktop applications and constant internet access. However, with the advent of smartphones and reliable internet connections, traders can now execute trades, monitor market movements, and manage their portfolios from virtually anywhere.

Advantages of Mobile Forex Trading

There are numerous benefits to mobile forex trading that are driving its exponential growth:

- Accessibility: Mobile trading apps enable traders to access the forex market 24/7, ensuring that they can react promptly to market changes and news events no matter where they are.

- Real-time Data: Traders can access real-time market data, charts, and news updates directly on their devices, which facilitates informed decision-making at any given moment.

- User-friendly Interfaces: Many mobile trading platforms are designed with simplicity and usability in mind, allowing novice traders to navigate the app with ease while still providing advanced tools for experienced traders.

- Quick Execution: The speed at which users can execute trades on mobile platforms can be significantly faster compared to desktop trading, which can be critical in volatile market conditions.

- Flexibility: The ability to trade from anywhere enables traders to seize opportunities that they might otherwise miss due to time constraints or geographic limitations.

Choosing the Right Mobile Trading Platform

With numerous mobile trading platforms available, selecting the right one can be quite overwhelming. Here are key factors to consider when choosing a mobile forex trading app:

- Reputation: Research the broker’s reputation and regulatory compliance to ensure the safety of your funds.

- User Reviews: Check user reviews and feedback for insights into other traders’ experiences with the platform.

- Available Features: Look for essential features such as charting tools, technical indicators, news feeds, and customization options that cater to your trading style.

- Customer Support: Ensure that the platform provides reliable customer support to assist you with any queries or issues that may arise.

- Fees: Review the fee structure, including spreads, commissions, and withdrawal charges, to understand the cost of trading on the platform.

Popular Mobile Trading Apps

Several mobile trading apps have risen to prominence in the forex trading community, each offering a unique set of features suited to different trading styles:

- MetaTrader 4 (MT4): One of the most widely used trading platforms globally, MT4 offers a comprehensive range of tools, charts, and indicators for technical analysis, along with the capability to automate trading through Expert Advisors.

- MetaTrader 5 (MT5): The successor to MT4, MT5 provides additional features, including enhanced charting tools, more timeframes, and support for trading stocks and commodities, along with forex.

- cTrader: Known for its user-friendly interface and advanced trading functionalities, cTrader is favored by traders who seek a balance of simplicity and sophistication.

- Thinkorswim: Offered by TD Ameritrade, Thinkorswim is renowned for its powerful analysis tools and educational resources that can benefit both novice and experienced traders.

- NinjaTrader: A great option for advanced traders, NinjaTrader focuses on futures and forex trading, offering robust charting capabilities and customizable automated trading strategies.

Developing a Mobile Trading Strategy

Success in mobile forex trading is not solely about picking the right platform; it’s also about implementing a robust trading strategy. Here are some steps to help you develop a winning mobile trading strategy:

- Define Your Goals: Establish clear trading goals, whether they involve generating passive income, aggressive speculation, or capital preservation.

- Analyze the Markets: Utilize technical and fundamental analysis to monitor market trends, economic indicators, and news that could impact currency pairs.

- Risk Management: Implement risk management strategies, such as setting stop-loss orders, to protect your trading capital from significant losses.

- Stay Informed: Continuous learning is vital in the ever-changing forex landscape. Stay updated on market news, emerging trends, and new trading strategies.

- Practice Patience: Successful trading requires patience and discipline. Avoid making impulsive decisions based on emotions or market noise.

Common Mistakes to Avoid

As with any form of trading, mobile forex trading comes with its own set of pitfalls. Here are some common mistakes to be aware of:

- Lack of a Plan: Trading without a clear plan can lead to erratic and unprofitable trading decisions.

- Over-leveraging: Using excessive leverage can amplify losses and potentially lead to margin calls.

- Ignoring Market Conditions: Failing to account for economic reports, geopolitical events, or market sentiment can result in costly trading errors.

- Inadequate Risk Management: Neglecting to set stop-loss orders and manage position sizes increases the risk of significant drawdowns.

- Overtrading: Chasing losses or attempting to recover from bad trades can lead to higher transaction costs and further losses.

Conclusion

Mobile forex trading serves as an indispensable tool for modern traders, offering unprecedented flexibility and accessibility to the forex market. By understanding the advantages, choosing the right platform, developing a strong trading strategy, and avoiding common pitfalls, traders can position themselves for success in this dynamic environment. As technology continues to evolve, staying informed and adapting to changes will be crucial for anyone looking to excel in mobile forex trading.