Online Forex trading has emerged as one of the most accessible and lucrative ways to invest in the global financial markets. With just a computer or smartphone and an internet connection, traders can access currency pairs and make trades at any time of day or night. As interest in Forex trading rises among investors, it’s essential to understand the fundamental aspects of this market, alongside the risks and benefits it presents. This article will provide insights into effective trading strategies, the tools available for traders, and tips for improving your trading skills. If you’re seeking a reliable partner in your trading journey, consider finding out more about trading forex online Jordan Brokers.

Understanding Forex Trading

Forex, or foreign exchange, involves the buying and selling of currencies from around the world. Unlike traditional stock markets that operate during specific hours, the Forex market is open 24 hours a day, five days a week. This continuous operation is due to the global nature of Forex trading, with major financial centers in different time zones including London, New York, Tokyo, and Sydney.

Key Concepts in Forex Trading

Before diving into strategies and tools, it’s crucial to understand some key concepts in Forex trading:

- Currency Pairs: Trading in Forex is done in pairs, where one currency is exchanged for another. Major pairs include EUR/USD, GBP/USD, and USD/JPY.

- Pips: Pips are the smallest price move a currency can make based on market convention. Usually, a pip is the fourth decimal place in a currency pair.

- Leverage: Forex trading often allows for leverage, which can amplify both gains and losses. Traders should understand the risks associated with high leverage.

Effective Trading Strategies

Successful Forex trading requires well-thought-out strategies. Here are a few popular trading strategies that can be employed:

1. Scalping

Scalping is a short-term trading strategy that focuses on making small profits on minute price changes. Scalpers typically hold their positions for a few seconds to minutes, utilizing high leverage and tight stop-losses.

2. Day Trading

Day trading involves entering and exiting positions within the same trading day. Day traders avoid holding overnight positions to mitigate risks associated with price changes after market hours.

3. Swing Trading

Swing traders hold positions for several days or weeks, capturing price swings. This strategy requires more patience and a keen analysis of market trends.

4. Position Trading

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This approach requires a solid understanding of fundamental analysis and macroeconomic factors.

Essential Tools for Forex Traders

To aid in your trading journey, various tools can enhance your ability to analyze the market and make informed decisions:

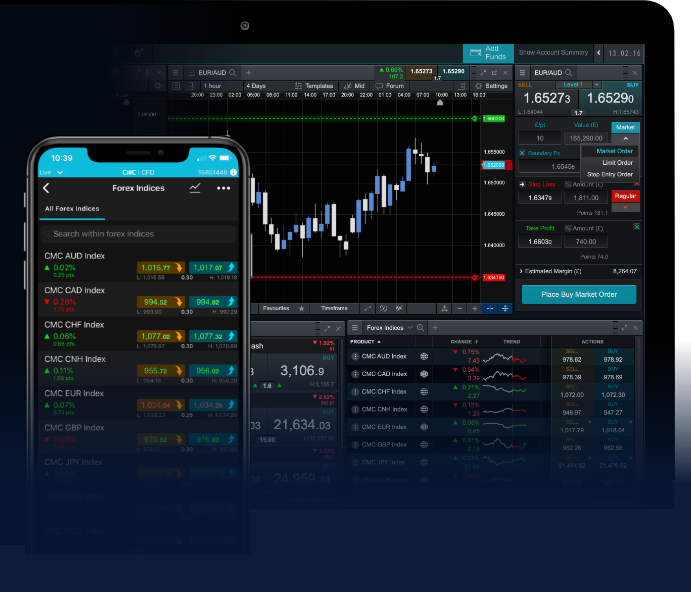

1. Trading Platforms

Forex trading platforms, such as MetaTrader 4 and 5, offer the necessary functionalities for executing trades, analyzing market trends, and managing accounts. These platforms often come equipped with various analysis tools and indicators.

2. Economic Calendars

Economic calendars provide crucial information about economic events that can impact currency prices. Keeping track of interest rate decisions, employment reports, and other significant indicators can help traders anticipate market movements.

3. Charting Software

Advanced charting software allows traders to visualize price action and apply technical analysis indicators. Tools such as trend lines, moving averages, and oscillators can aid in identifying potential entry and exit points.

4. Trading Journals

Maintaining a trading journal enables traders to track their trades, analyze their performance, and identify areas for improvement. Recording the rationale behind each trade can help refine strategies over time.

Risk Management in Forex Trading

Risk management is an integral part of Forex trading. Effective risk management strategies can help protect your capital and maximize your chances for success:

1. Setting Stop-Loss Orders

Stop-loss orders automatically close a position once a certain price level is reached, minimizing potential losses. Always use stop-loss orders to limit your exposure in volatile markets.

2. Risk-to-Reward Ratio

Before entering a trade, establish a risk-to-reward ratio to determine whether the potential rewards justify the risks. Many traders aim for a ratio of at least 1:2 or higher.

3. Diversification

Diversifying your investment by trading multiple currency pairs can help minimize risk. This prevents your portfolio from being overly reliant on a single currency’s performance.

Continuous Learning and Adaptation

The Forex market is constantly evolving, requiring traders to stay informed and adapt their strategies. Books, online courses, webinars, and trading forums can provide valuable insights and education. Additionally, learning from both successful and unsuccessful trades is essential for growth as a trader.

Conclusion

Online Forex trading offers exciting opportunities for investors willing to learn and adapt. By establishing effective trading strategies, utilizing essential tools, and committing to risk management practices, traders can navigate this dynamic market successfully. Whether you are just starting or looking to enhance your existing skills, continuous education and practice are key. Remember, finding a reliable broker like Jordan Brokers can further support your trading journey and provide the necessary resources for success.